General

-

Promissory Note vs. Security Instrument: What’s the Difference?

Is there even a difference? Absolutely—there’s a significant difference. Let’s break down each one, then…

-

7 Ways to Maximize the Value of Your Real Estate Note

Are you about to sell your property with seller-financing?Do you want to make sure you…

-

Potential Problems for Noteholders: How to Protect Your Investment

Most noteholders only own a single promissory note. Often, they became noteholders reluctantly—selling their property…

-

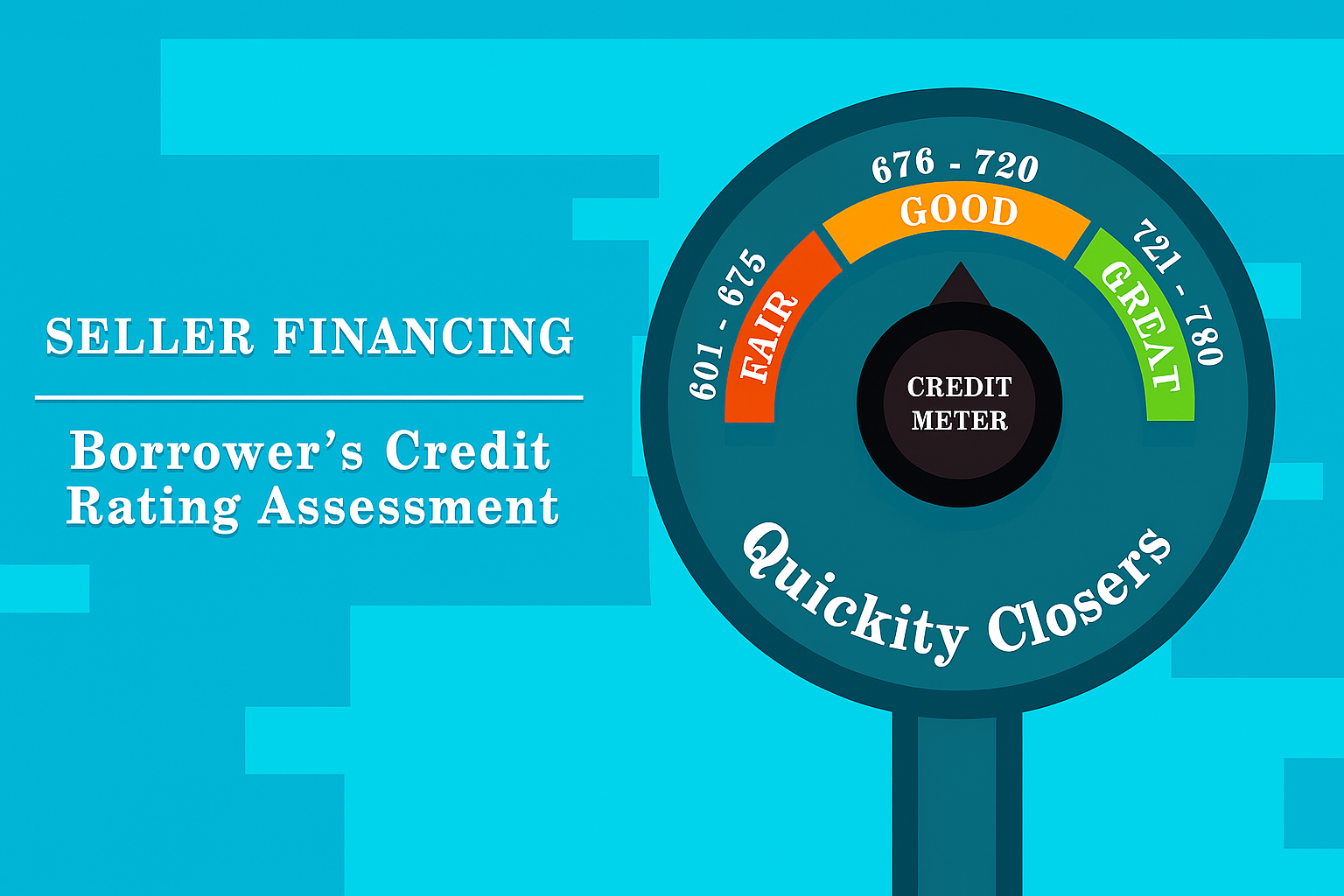

6 Factors That Influence the Resale Value of Seller-Financed Notes

Seller financing is a powerful tool for property owners looking to close deals quickly, especially…

Search

Latest Posts

At Quickity Closers, we simplify the complex world of note selling. Our blog covers everything from how to sell a mortgage or trust deed note, to understanding the difference between promissory notes and security instruments. Learn how to maximize the value of your real estate note, evaluate borrower credit, structure seller-financed deals, and navigate partial note sales. Whether you’re a first-time noteholder or a seasoned investor, we provide the insights and tools you need to make informed, profitable decisions