Is there even a difference?

Absolutely—there’s a significant difference. Let’s break down each one, then explore why it’s best to have both a promissory note and a security instrument when dealing with real estate transactions.

What Is a Promissory Note?

A promissory note is essentially a written promise to pay—a formal IOU between a borrower and a lender. It outlines the terms of the loan, including repayment schedule, interest rate, and maturity date. Unlike a deed or mortgage, the promissory note is not recorded in county land records. Instead, the lender retains it as proof of the debt.

Promissory notes are transferable and can be sold to other investors. Because they represent a legal obligation to repay, it’s critical to store them securely. For a deeper legal breakdown, see The Balance’s guide to promissory notes.

What Is a Security Instrument?

A security instrument protects the lender by securing the promissory note with collateral—typically the property itself. If the borrower defaults, the lender has legal remedies to recover the debt, such as foreclosure.

There are several types of security instruments used in real estate:

- Mortgage: Common in states like Florida and New York

- Deed of Trust: Used in states like California and Texas

- Land Contract: Often used in seller-financed deals

The type of instrument depends on state law. For a detailed comparison, check out NFM Lending’s breakdown of deeds, notes, and deeds of trust.

Why You Need Both

Having both a promissory note and a security instrument ensures that:

- The borrower is legally obligated to repay

- The lender has recourse if the borrower defaults

- The transaction is enforceable and transferable

The Critical Elements of a Promissory Note

Promissory notes are governed by state law, but most include the following key components:

- Payor: The borrower who agrees to repay the debt

- Payee: The lender or entity receiving repayment

- Date of the Note: When the obligation begins

- Loan Amount: Total principal borrowed

- Interest Rate: Fixed or adjustable

- First Payment Due Date: Typically with a 15-day grace period

- Maturity Date: Final payment deadline

- Prepayment Penalties: May apply if the loan is paid off early

For a comprehensive overview, visit LegalClarity’s guide to promissory note elements.

Final Thoughts

Understanding the distinction between promissory notes and security instruments is essential for anyone involved in real estate lending. Together, they form the backbone of a secure, enforceable loan agreement. If you’re considering selling or creating a real estate note, make sure both documents are properly drafted and stored.

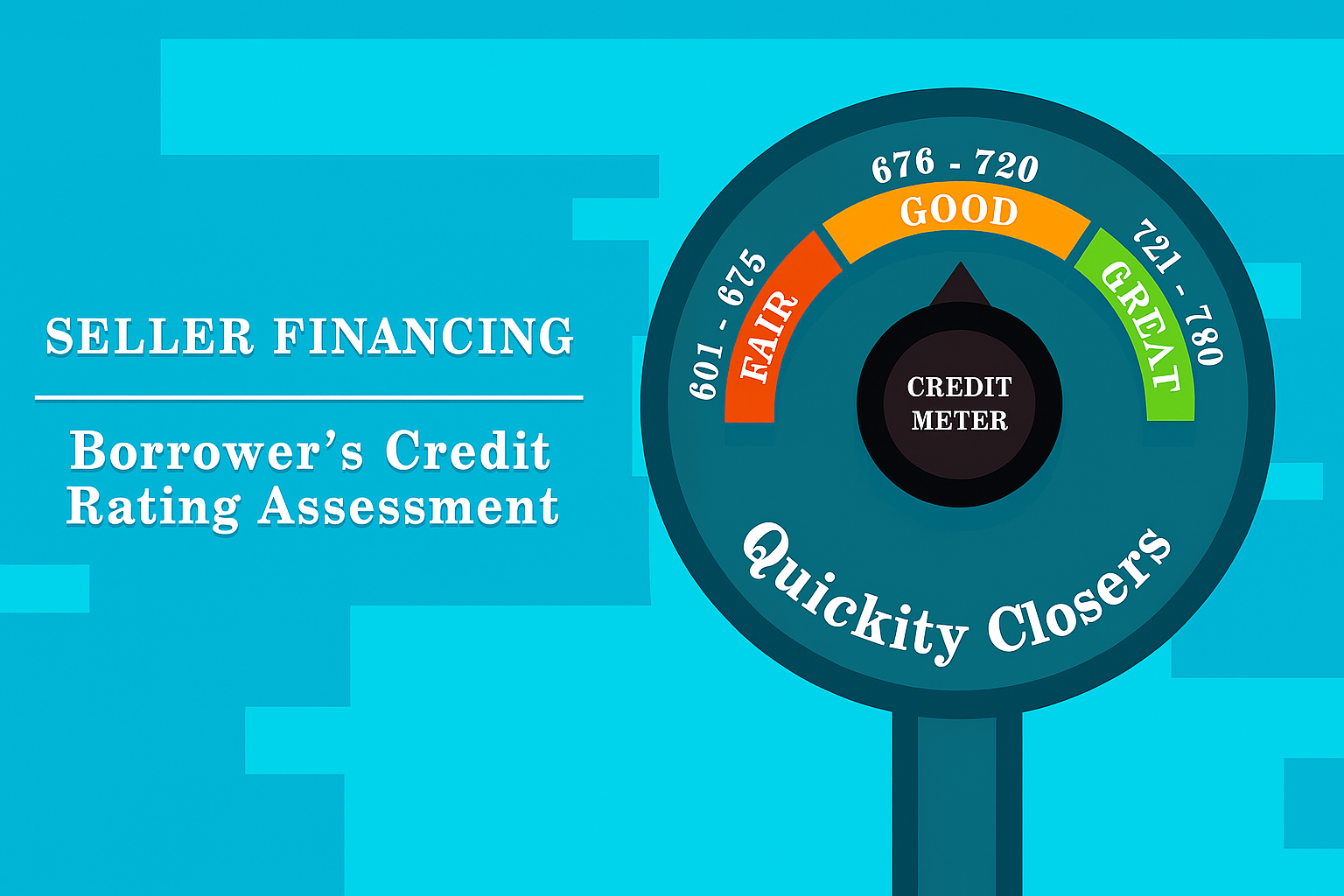

Quickity Closers purchases promissory notes. For a free, no-hassle Note Quote, call Quickity Closers at 1-855-724-2511.